INTRODUCTION

Accounting means different things to different people. To your accountant, it means analysis of your accounts data to produce Profit & Loss and Balance Sheet reports (note, these are now often called 'Statement of Income', and 'Statement of Financial Position'). The Profit & Loss report, as the name suggests, tells you whether your business made a profit or a loss, how much was sold, and what sort of things were purchased. It's all about sales and expenses (including purchase of any stock). The Balance Sheet tells you the 'book' value of your business. Items owned by your business such as vehicles, plant equipment, computers, buildings, stock, etc. and amounts owed to the business by it's customers (debtors) are all called 'Assets'. They are all worth something. Things like amounts outstanding on loans or hire purchase, tax owed, amounts owed to suppliers (creditors), etc. are all called 'Liabilities'. The 'book' value of the business therefore is its assets less its liabilities. We say this is the 'book' value, because it's not a true reflection of what the business is worth. The real value of a business also includes things like goodwill, any patents or copyright, agreements protecting it's trade in some way, market potential, and so on. All this accounting activity is handled by the Nominal Ledger.The Nominal Ledger consists of a set of accounts. Each account is for a particular type of sale or purchase (there are three types of purchase: expense, fixed asset, and stock). For example, you'll have one account for rent, one for office consumables, one for advertising, one for stock, and so on. You could use more than one account of a particular type of sale or expense if you wished. For example, if your main business is selling red widgets and green widgets, you might want to set up an account for each. So you can compare the sales between red and green widgets. Most accounting systems, including Adminsoft Accounts, will set up some basic accounts for you when you install it. In theory, you could run your business just using the Nominal Ledger. And some very small businesses that only operate on a cash basis, and don't offer credit to customers or require credit from suppliers, do just that. However, most businesses give some customers credit, and nearly all businesses receive credit from suppliers. This is where you require more than just the Nominal Ledger, because you need to be able to enter the sales invoices into the system for each customer and supplier, record if/when they are paid, and keep track of who owes you money, and who you owe money to. This is the function of the Sales Ledger and Purchase Ledger. There is an added benefit to using Sales and Purchase ledgers, in that it is easier to record VAT/Sales Tax.

To many small businesses, accounting also means invoices, payments, and keeping track of money owed to the business, and money owed by the business. Often, they do not use the Nominal Ledger at all, but will rely on their accountant to 'put the accounts together' at the end of their financial year. Many accounting systems do not like this approach, and insist on various Nominal Ledger functions being carried out at the end of an account period and account year, whether you wish to use the Nominal Ledger or not. In Adminsoft Accounts however, there is no account period or year end procedure (it's all automatic), and it does not insist the Nominal Ledger is used. It allows users to completely ignore it if they wish.

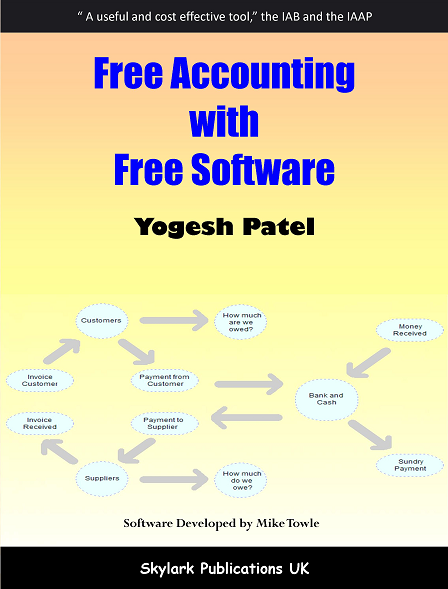

In a nutshell, that's it. An accounts system basically consists of three ledgers: Nominal Ledger, Sales Ledger, and Purchase Ledger.

You might be thinking 'the Nominal Ledger sounds like it could be really useful, why do many small businesses not bother with it?". The answer is double entry accounting. This system has been with us for around five hundred years. When transactions were all written up by hand into actual ledgers (literally large books), double entry accounting was very useful. It helped to make sure the accounts were correct. This is because in double entry accounting, every transaction creates at least two (and usually more) transactions in the Nominal Ledger. These are called 'postings'. For example, if you had a sales invoice for $100 that had already been paid, you would make one posting into the sales account, and one posting into your cash account (assuming it was paid in cash). The postings would literally be entered into different books. One would contain the sales account and the other (often referred to as the 'cash book') would contain all the transactions paid into or out of cash. This is where the term 'bookkeeper' comes from. To make sure things balance, the total value of the postings for each transaction must balance. Each transaction consists of two half's: debit and credit. All debit postings must equal all credit postings. So in our example, $100 would be credited to the sales account and $100 debited to the cash account. Don't think about debit and credit in terms of your bank account or statement. When it comes to double entry accounting, the terms 'debit' and 'credit' exist for convenience, don't think of them in terms of subtraction or addition, otherwise it'll get very confusing! In some circumstances a debit can add to an account, in other circumstances it can subtract from an account. So can a credit. Most people learning about double entry accounting find this the most baffling aspect of it, by a long way. It takes a long time before you learn which accounts should be debited and which should be credited and under what circumstances. This is why many small businesses stay away from the Nominal Ledger!

With computerised accounting systems, double entry accounting should be redundant. It should have been consigned to history years ago. Software can make sure everything balances. But double entry accounting is so ingrained in the world of accountancy, that any accounting system that does not use it is not treated seriously by accountants. So all mainstream accounting packages, including Adminsoft Accounts, have to use it. The difference is, Adminsoft Accounts won't force you to use it if you don't want to.

SALES AND CUSTOMERS

I would advise you put ALL sales through the Sales Ledger. This ledger is designed from the ground up specifically to handle sales transactions. Whether they are cash or credit. As such, it makes it easy for you to enter any sales related transactions, and easy to keep track of them.There are four main types of sales transaction: Invoice (for when you sell something), Credit Note (for when you agree with your customer to reduce the amount they owe you, perhaps for faulty goods/service or returned goods), Payment Received (for when you receive some money from your customer), and Refund (for when you pay some money back to your customer). Some people confuse 'Refund' with 'Credit Note', but they are different things. There are other types of transactions, but they are seldom used, so I won't cover them here. In Adminsoft Accounts, the other types are only available if you are running the software in 'Level 2: Advanced Level'.

The Sales Ledger consists of customer accounts. When you set up an account, you can specify the customers credit terms. It might be they are a cash customer, who always pay when placing their order or on collection of the goods, or a credit customer who can place an order, and then is given a certain time in which to pay your invoice, 30 days of the invoice date is typical. This will allow you to enter transactions into their account, and so at any time you can see exactly how much they owe you, how old that debt is, and how much business they have placed with you over any given period. A lot of this information is useful not just from an accounting point of view, but it can also be a very useful marketing tool.

When you have customers who owe you money, it's a good idea to give them a gentle reminder every so often. So most accounts systems can generate Statements. These are reports that list each transaction that is outstanding (ie. hasn't yet been paid in full) for each customer. The statement can then be posted, faxed, or emailed to each customer. As well as reminding your customer they still owe you money, it also gives them an opportunity to reconcile their own accounts. In other words, they can check to make sure they physically have all your invoices, and make sure they have been entered on their own accounts system correctly.

To create a sales invoice, first a customer account must exist. When entering the invoice itself, each invoice line is for a service item or stock item. You would first enter the quantity, then specify the item, then enter a sale analysis code (this says what type of service of stock item it is), then a VAT code, and then the amount you are selling the item for. The computer will automatically maintain totals for VAT and the invoice total. When you've entered everything, you'll need to enter a short description, to remind you what the invoice is or (this short description will often appear next to the invoice number is various places in the accounts system). You can then click one button which will post the invoice to the customer account, and make all necessary postings into the Nominal Ledger, and then print the invoice out. If the customer is a cash customer, it will ask for details of the payment. If the customer is a credit customer, the invoice will appear in their account with an outstanding balance.

When a credit customer pays you, you will enter the payment into their account in the Sales ledger. It will then ask you if you want to allocate the payment. This is because the system needs to know which invoice or invoices the payment is intended for. If the payment is not allocated, it will sit in the customers account with an outstanding balance. Even if the invoice less the payment equals zero. Transactions that have an outstanding balance are called 'current' transactions, and will appear in the list of current transactions. Once a payment has been allocated, the payment and any transactions it was allocated to (provided their outstanding balance has reduced to zero) will no longer be current, and will be listed under 'history'. At that point, they are finished with and you will no longer be interested in them (unless a query arises).

When talking about entering sale invoices above, I mentioned 'Sales Analysis' codes. These are alphanumeric codes, up to 8 characters long. They are used to help you analyse exactly what sort of things you have been selling. When Adminsoft Accounts is installed, it sets up one for you, called 'MISC'. You can if you wish, always just use that one code that's already there. But most likely you will want to create your own codes. For example, if you sell bathroom appliances, you might want to set up a code for baths, one for toilets, another one for wash basins, and so on. Reports are available that allow you to see what kinds of items have been selling over any given period. You see how useful sales analysis codes are? In most other accounting systems, sales analysis codes aren't used. You have to enter a Nominal Ledger account. But this assumes you are familiar with Nominal Ledger, and it also means you have to create lots of extra accounts in the Nominal Ledger if you want to do the kind of sales analysis discussed above. In Adminsoft Accounts, when creating a sales analysis code, you do have to enter a Nominal Ledger account. But you can use the same account, if you wish, for all sales analysis codes. The default sales account in the Nominal Ledger is 4000. So you could just use that.

PURCHASES AND SUPPLIERS

This bit is easy, because it's almost identical to the 'Sales and Customers' section above. The main difference, is that when entering invoices, you enter a 'Purchase Analysis' code instead of a 'Sales Analysis' code. Like sales analysis codes, purchase analysis codes allow you to analyse your purchases over any given period. However, unlike sales analysis codes, there are a lot of them, to cover the wide range of products and services you may be purchasing. Also, each purchase analysis code is likely to link to a specific Nominal Ledger account for that particular product/service. By default, the Nominal Ledger only has one account for sales, but it will over 30 set up to handle purchases.You would use purchase analysis codes not just for expenses, but also for stock. When the system is installed, only one account is set up for stock. But you may wish to create others, or you can simply relay on purchase analysis codes (and stock control if you use it) for your analysis.

STOCK CONTROL

Stock control is all about recording your stock items (these are items for resale, not expenses or assets such as your office furniture, etc.) and keeping track of how many of each item you have in stock. This also involves setting a price you will be selling at (the retail price), and keeping track of how much the items have cost you.The first step is to create your stock items in the accounts system. In the item details in most stock control systems you can enter a minimum quantity. This is the level below which you do not wish the stock level to fall. Every so often you can then produce a report that will highlight any items that are near or have fallen through the minimum stock level. So you know what items you need to purchase to replenish your stock. Where a system has Purchase Order Processing built in (as Adminsoft Accounts does), you can get it to raise a Purchase Order automatically, which can then be sent straight to your supplier.

However, we're getting ahead of our selves, because after creating the stock items, the next step is to enter any opening balances, if any. This includes not just the quantity your currently have in stock, but the cost of them also. The software can then work out the cost of any items sold. When ever you receive new stock, that needs to be entered into the system, along with the cost.

Stock control is one of those things that looks like it should be quite straight forward, but can actually get very complicated. The thing that makes it very complicated is the cost of an item. There are numerous problems that make costing very difficult, the common ones are:

1) Items can often cost different amounts when purchased at different times. For example, lets say you have 5 widgets left in stock, and cost you 12.50 each. You then go and buy another 10 at 13.25 each. When you next sell one, how do you work out the cost of it? This is discussed in detail below.

2) If an item is returned by a customer and put back into stock, in theory you need to locate the original sales transaction and find the cost of the item at that time, and use that cost when booking the item back into stock. But in a busy office or retail environment, people often don't have the time to do that, and so will use the current cost of an item, which may not be the cost when that item was sold. Worse, they may enter no cost at all.

3) Sometimes, a stock item can be sold before it's been booked into stock! When this happens, all the software can do is 'guess' at what the cost might be. For this reason, some stock control systems will not allow stock to be booked out if the system shows none in stock (in Adminsoft Accounts, this feature is user selectable).

4) Stock purchased will frequently incur some sort of delivery or freight charge. This is rarely added to the cost of the stock item, as it can be time consuming to work out. As the cost may vary depending on the size and weight of each items just received, it would have to be apportioned accordingly. In practice these delivery/freight charges are usually just treated as an overhead.

5) When stock items are ordered via a Purchase Order, the actual charges by your supplier may be different. Suppliers can sometimes ignore the price on a P/O and just charge you according to their own price list. When you receive the items, you may only have a delivery note, and delivery notes often do not display prices. So you book the items into stock, assuming the prices on your P/O are correct. But they may not be.

It's easy to see how the above problems from 2 onwards can cause issues. Problem 1 can be addressed by implementing a method to work out the cost. But each has their advantages and disadvantages. There are four main methods:

FIFO - First In First Out. This is by far the most common method. It means the oldest cost is used first. In our example above where we have 5 widgets at 12.50 each and then purchased 10 at 13.25 each, the next five sales of that item will assume a cost of 12.50. Only when those first five are gone, would the system start selling the next ten, at a cost of 13.25 each. The disadvantage with using this method, is that it is still susceptible to errors due to the problems 2 and 3 discussed above.

LIFO - Last In First Out. Very rarely used. But it might be useful during times of high price inflation.

AVCO - Average Cost. When an item is sold, the cost of it is simply an average cost. So, in our example where we have 5 widgets at 12.50 each and 10 at 13.25 each, the cost would be 13,00 (ie. ((5 x 12.50) + (10 x 13.25)) / 15). The disadvantage with AVCO is the more the actual costs vary, the more inaccurate it becomes. Here's an extreme example just to prove the point: If we have 5 items in stock, one at 12.00 and the other four at 3.00, then using AVCO our cost will be 4.80. If the first item is then sold (with a cost of 4.80), this leaves four remaining items at 3.00 each, which of course makes the average cost now 3.00. So the cost of the first item sold was very inaccurate. The only way to improve accuracy might be to ignore what's sold, and just take an average cost based on all purchases of the item. But how far do we go back? One year, five, ten? The further back we go, the more inaccurate it becomes due to inflation.

LIST - List price. Where a stock item is given an assumed cost price, which is always used, regardless of actually cost. Although the cost price may be reviewed periodically. The advantage with this, is that the software always knows exactly what the cost is. The disadvantage of course, is that this assumed cost is often likely to differ from the actual cost.

You can see why FIFO is the most commonly used costing method. Although it can still produce inaccurate costings, it's generally more reliable than the other methods. Adminsoft Accounts offers all four methods of costing, but FIFO is the default.

When generating a Purchase Order from stock, the software will fill in the cost price of each item. This will usually be based on the cost of the last purchase of the item, or on the list cost if the item hasn't been purchased before.

CONCLUSION

That's basic small business bookkeeping. But I do mean 'basic', there's an awful lot more to bookkeeping and accounting. But the basic's discussed here should be sufficient to get you started off in the right direction.Adminsoft Accounts, can run at two different levels of complexity. Level 1, which is the default level used when you install the software, keeps things as simple and straight forward as possible. Though it doesn't contain stock control as such. You can enter stock item details, but it's treated more as a price list than a stock control system. However, put the software into Level 2, and it looks very different. A lot of extra options appear in the various menu's, account details show a lot more detail, and stock control changes dramatically, and turns into a full blown stock control system offering all sorts of options for controlling and analysing stock. If you're very new to bookkeeping, unless you desperately need stock control right away, I recommend you leave the accounts system running in Level 1 until you have more experience.

As far as I'm aware, Adminsoft Accounts is the only accounting system that offers two levels of functionality to make it easier for those new to bookkeeping.