Payroll - NI and Tax Bands Archive

This page contains an archive of all the settings used in previous years. However, you are unlikely to be able to enter these tables into the current version of Adminsoft Accounts. HMRC have made too many changes over the years. If you wanted to investigate previous years, you would have to install an older version of Adminsoft Accounts into a new folder, away from your current installation. Older versions of Adminsoft Accounts can be found here

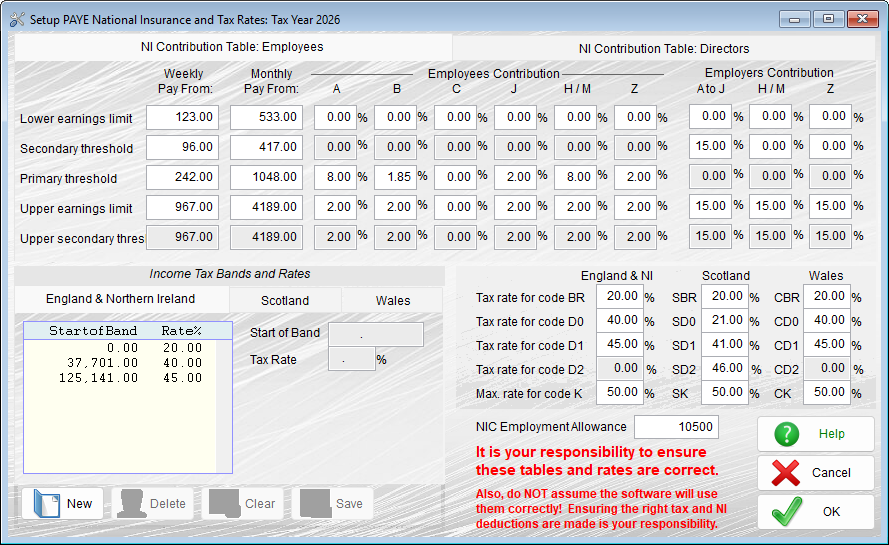

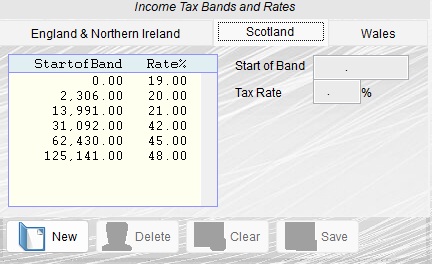

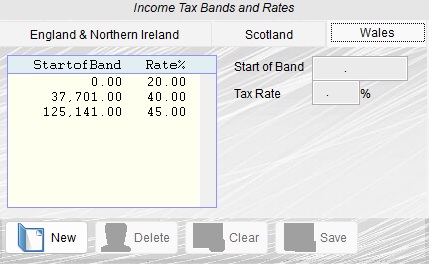

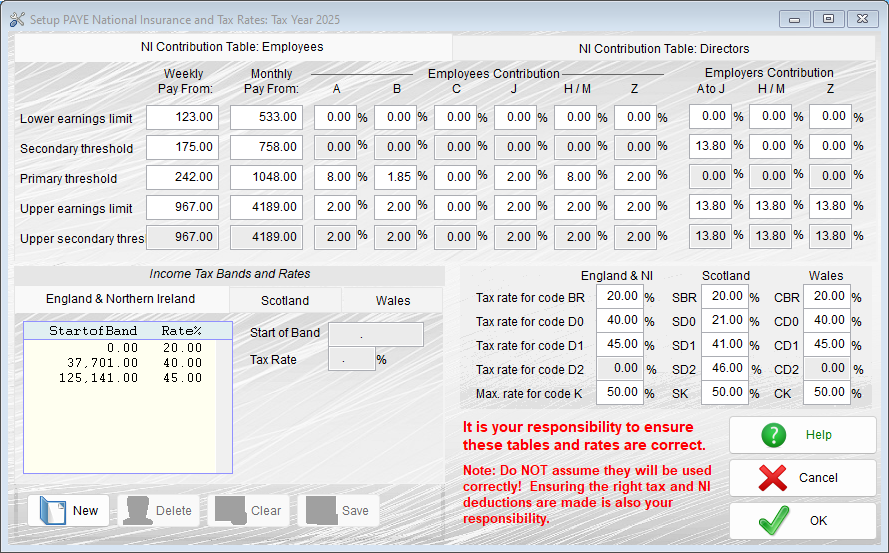

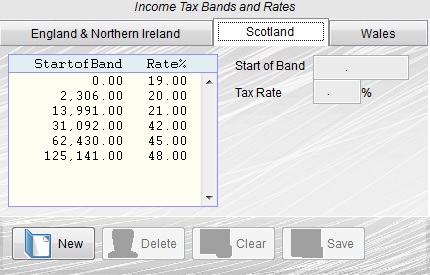

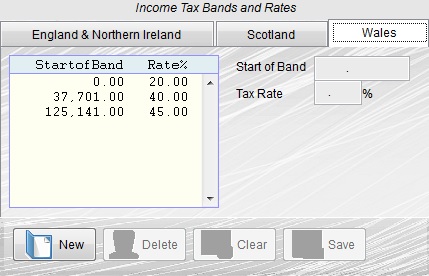

The values for the tax year 2025/26 (up to v4.298):

When you update the software the new NI and tax rates should be created automatically for you. But if not, please enter the details as above. NOTE: the rates and thresholds for student load deductions and workplace pensions are NOT automatically updated.

Note: the "NI Contribution Table: Directors" contains the same figures as for regular employees (they were different for part of the previous tax year, hence the two sets of NI tables).

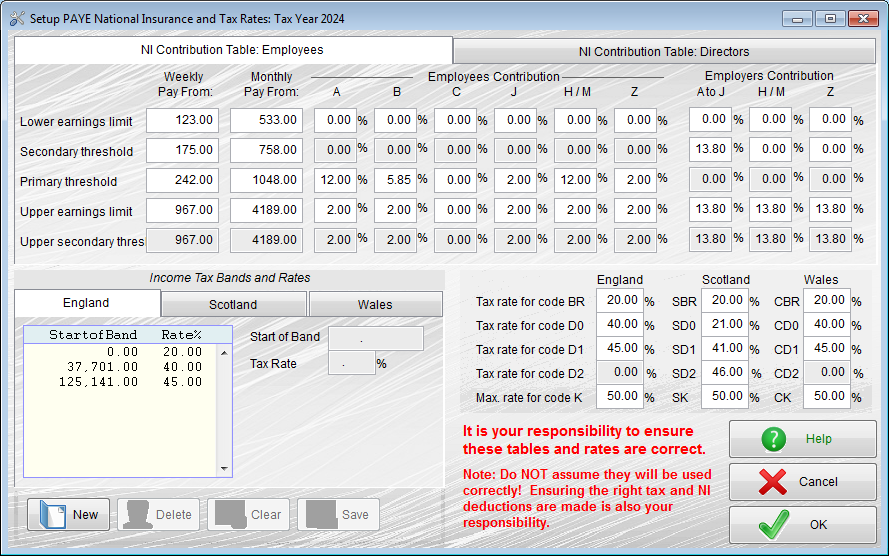

The values for the tax year 2024/25 (up to v4.289):

When you update the software the new NI and tax rates should be created automatically for you. But if not, please enter the details as above. NOTE: the rates and thresholds for student load deductions and workplace pensions are NOT automatically updated.

Note: the "NI Contribution Table: Directors" contains the same figures as for regular employees (they were different for part of the previous tax year, hence the two sets of NI tables).

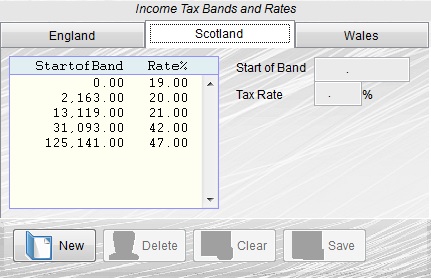

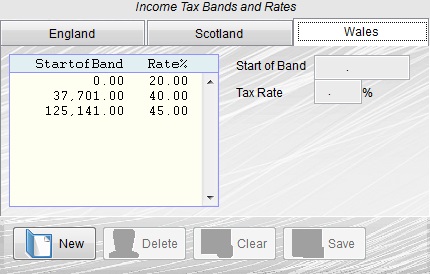

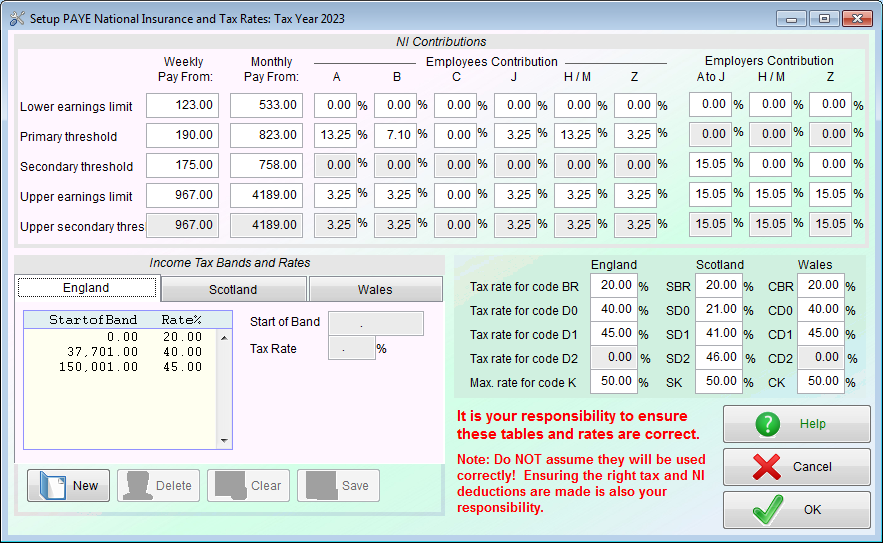

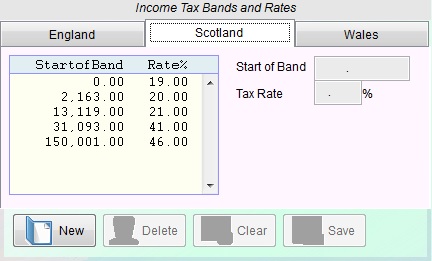

The values for the tax year 2023/24 (up to v4.271):

(note: from 6th Jan.'24 to 5th April '24 the 12% should be reduced to 10% (11.5% for directors) and 5.85% reduced to 3.85% (5.35% for directors)

When you update the software the new NI and tax rates should be created automatically for you. But if not, please enter the details as above. NOTE: the rates and thresholds for student load deductions and workplace pensions are NOT automatically updated.

Note: the "NI Contribution Table: Directors" contains the same figures as for regular employees (they were different for part of the previous tax year, hence the two sets of NI tables).

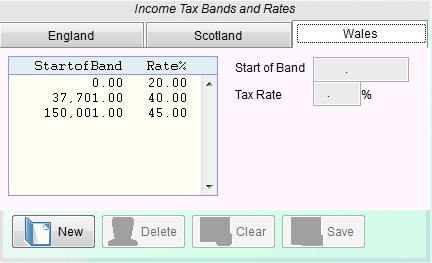

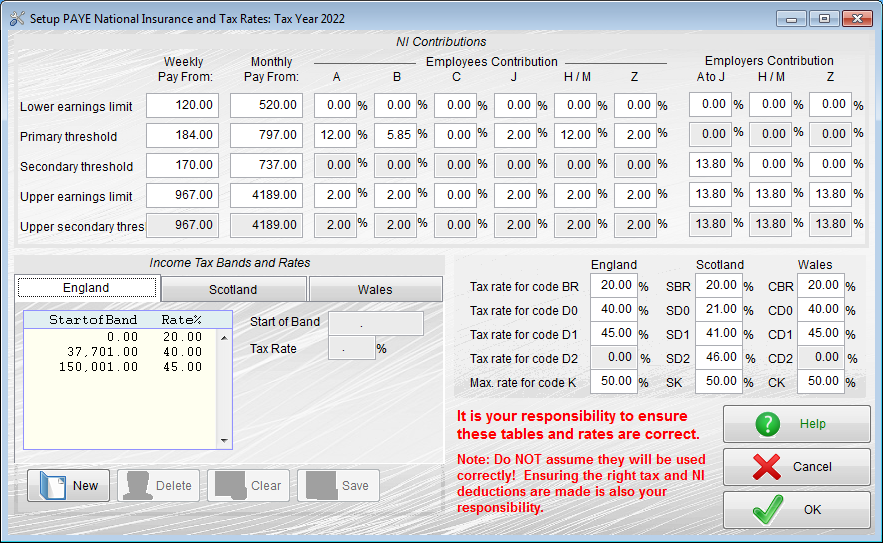

Values for the tax year 2022/23 (up to v4.256):

NOTE: From 6th July 2022 the NI Primary Threshold went up from £190/week to £242/week, and from £823/month to £1,048/month. The Secondary Threshold for employers did not change. Also, the NI rates changed twice over the tax year, and the rate for directors was different to regular employees (the software had to be changed to allow a sperate NI table for directors, not visible in the above image).

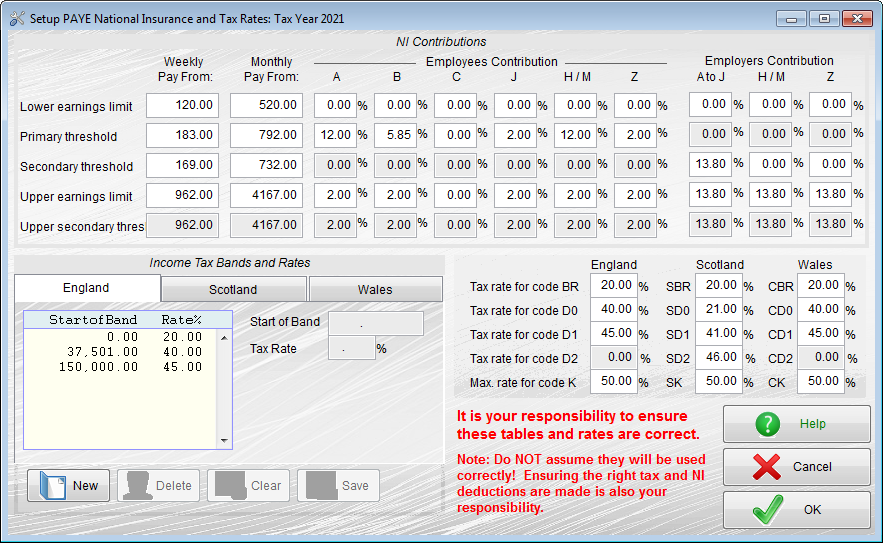

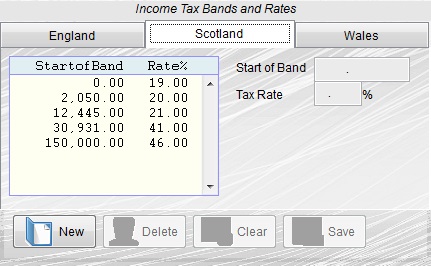

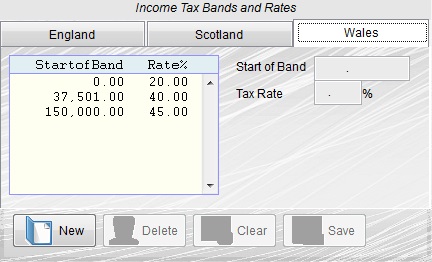

NOTE: From 6th July 2022 the NI Primary Threshold went up from £190/week to £242/week, and from £823/month to £1,048/month. The Secondary Threshold for employers did not change. Also, the NI rates changed twice over the tax year, and the rate for directors was different to regular employees (the software had to be changed to allow a sperate NI table for directors, not visible in the above image).Values for the tax year 2021/22 (up to v4.237):

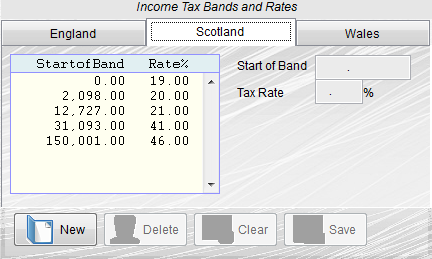

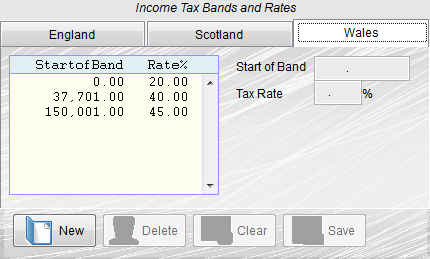

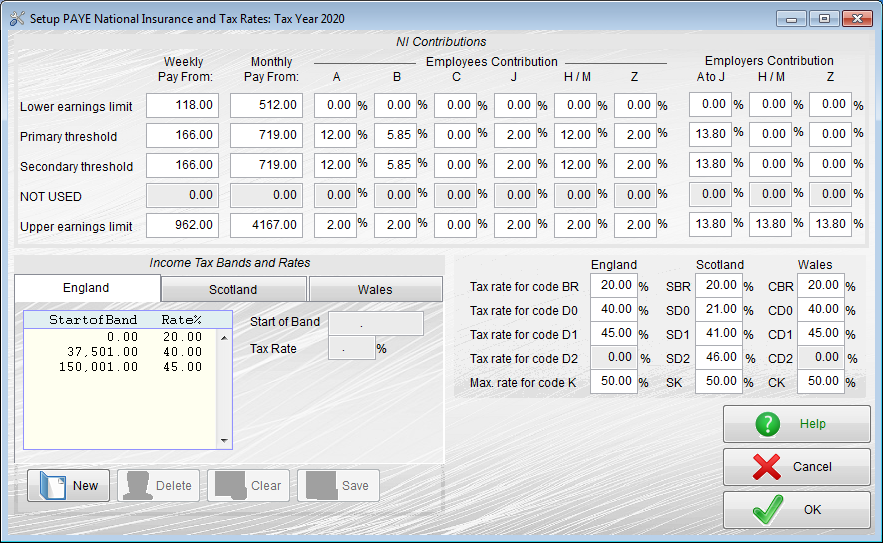

Values for the tax year 2020/21 (try v4.201):

NOTE: In Scotland the above tax rates should only be used up to the 10th May 2020, then they change to the following:

NOTE: In Scotland the above tax rates should only be used up to the 10th May 2020, then they change to the following:| Start of Band | Rate% | |||

| Starter rate | 0 | 19.00 | ||

| Basic rate | 2,086 | 20.00 | ||

| Intermediate rate | 12,659 | 21.00 | ||

| Higher rate | 30,391 | 41.00 | ||

| Top rate | 150,001 | 46.00 |

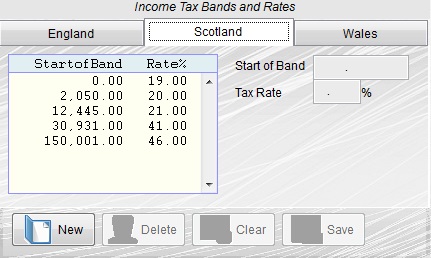

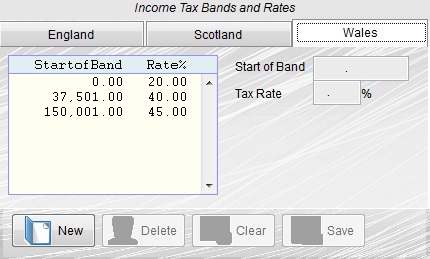

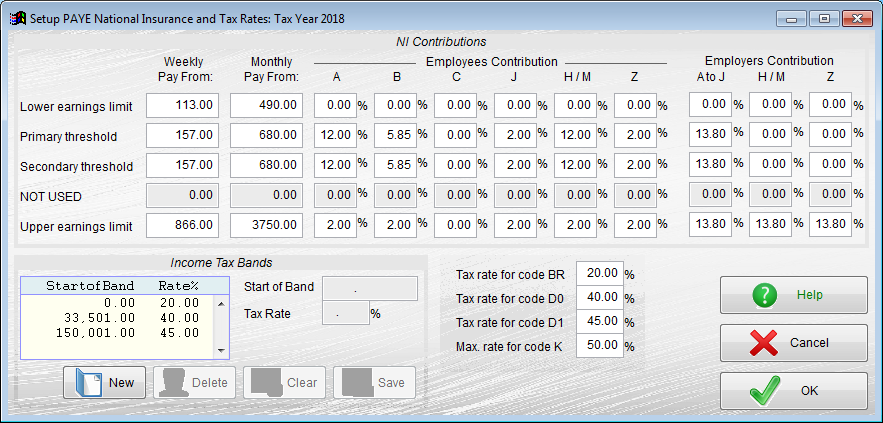

Values for the tax year 2019/20 (try v4.189):

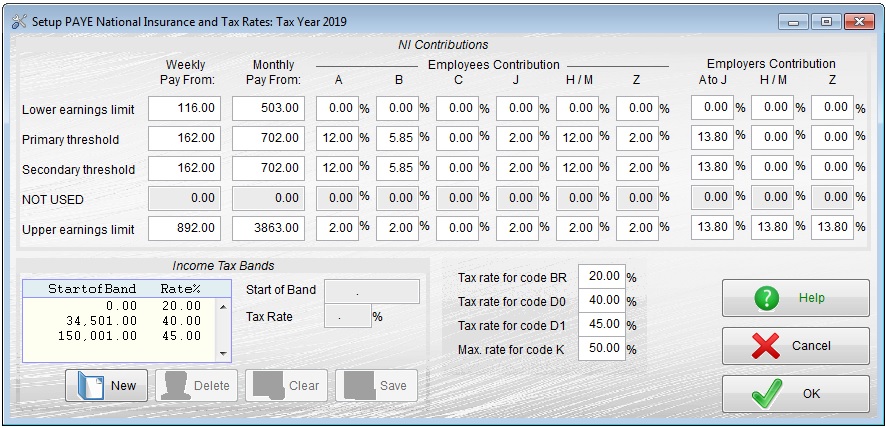

Values for the tax year 2018/19 (try v4.178):

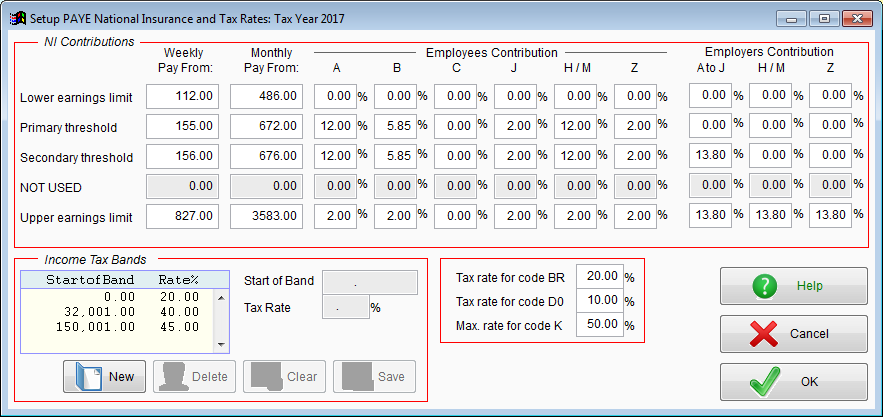

Values for the tax year 2017/18 (try v4.160):

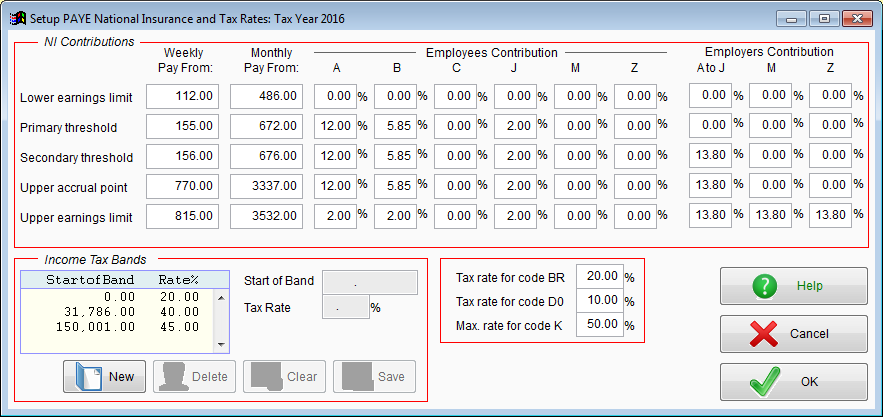

Values for the tax year 2016/17 (try v4.140):

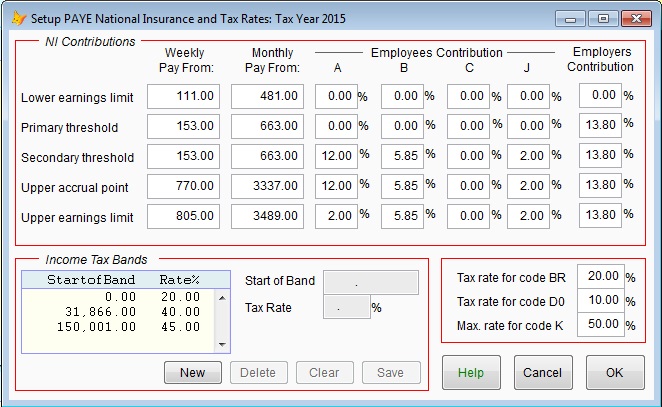

Values for the tax year 2015/16 (try v4.122):

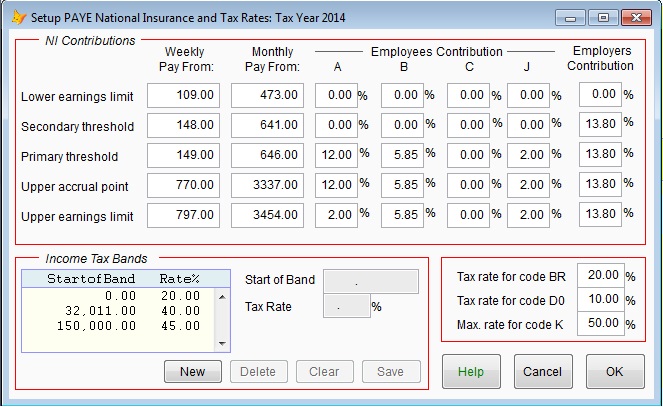

Values for the tax year 2014/15 (try v4.089):

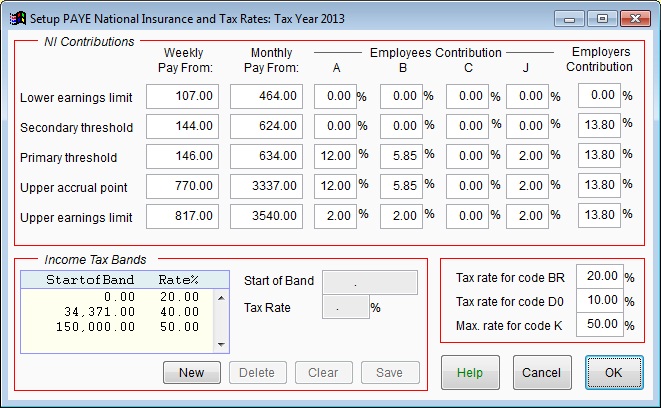

Values for the tax year 2013/14 (try v4.060):

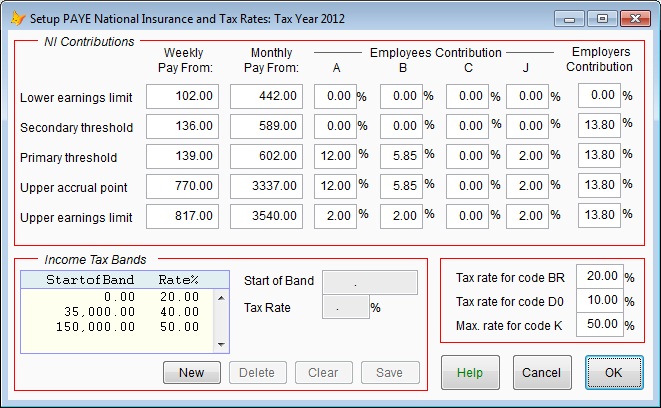

Values for the tax year 2012/13 (try v4.034):

Values for the tax year 2011/12 (try v4.005):

For information on RTI and its implementation, please click here.