Payroll

If you are based in the United Kingdom, and are using the payroll, please always download the latest version of Adminsoft Accounts, as HMRC do tend to change things occasionally.

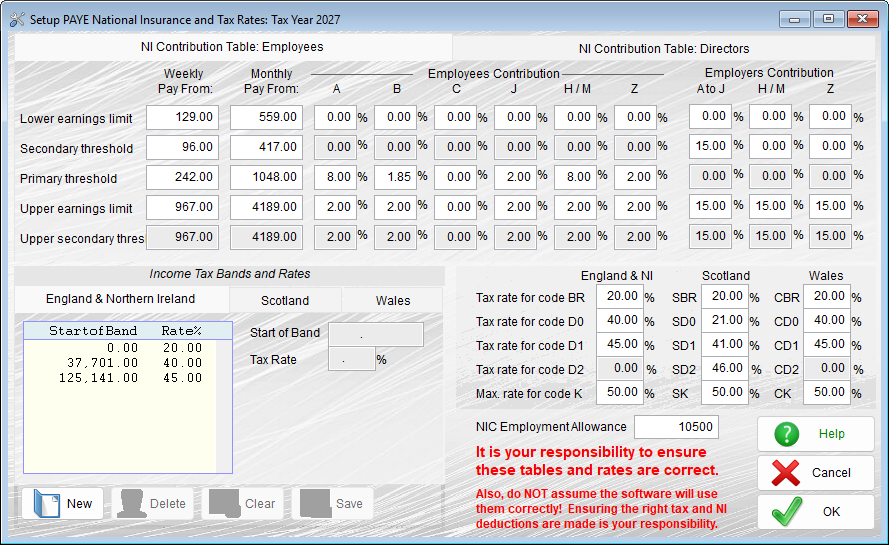

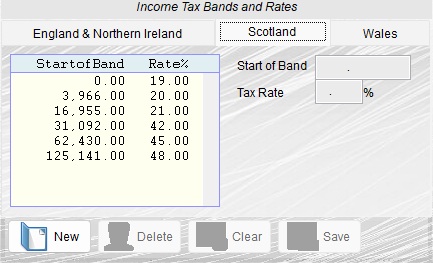

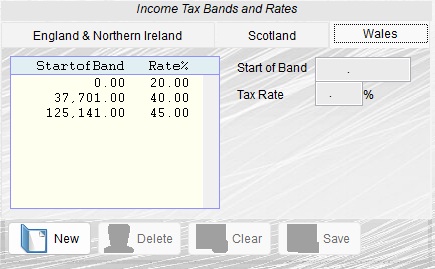

The values for the tax year 2026/27 should be as follows:

When you update the software the new NI and tax rates should be created automatically for you. But if not, please enter the details as above. NOTE: the rates and thresholds for student load deductions and workplace pensions are NOT automatically updated.

Note: the "NI Contribution Table: Directors" contains the same figures as for regular employees (they were different for part of tax year 2022/23, hence the two sets of NI tables).

As always, it is your responsibility to check the software is doing everything correctly. In particular we strongly recommend that you regularly check the output of your payroll against one of the free on-line payroll calculators that are available. We can not guarantee the information presented here is correct, or that the software correctly processes any information input.

For information on RTI and its implementation, please click here.

To view settings from previous years (goes back to tax year 2011/12), please click here.