Construction Industry Scheme (CIS)

Whether you operate as a contractor or sub-contractor, all the facilities you are likely to need are there.

As a sub-contractor:

You can set a default CIS deduction on each customer account. As some accounts may not be subject to CIS, while others may require a 0%, 20% or 30% deduction. This deduction is then automatically generated when you create a sales invoice, though it can be edited.

As a contractor:

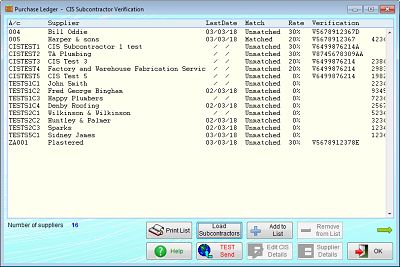

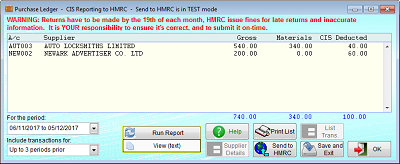

Things are a little more complicated, but everything you need is right here. You can set a deduction rate for each of your sub-contractors, either manually or by using the built in CIS verification facility. You can keep track of your sub-contractors, how much has been deducted from each invoice (which is done automatically based on the labour charge, but the amount can be edited), and file CIS Returns to HMRC directly from within Adminsoft Accounts.

For full details, you can download the free user guide from here, or click on the User Guide button at the top of this page.

- Submission of CIS Returns and Verification requests directly from within Adminsoft Accounts approved by HMRC

- Handles CIS deductions on sales invoices

- Handles CIS deductions on purchase invoices

- If you are using the VAT Cash Accounting Scheme the software takes CIS deductions into account when invoices are paid or part paid

- Free user guide available to instruct you how to operate CIS using our software

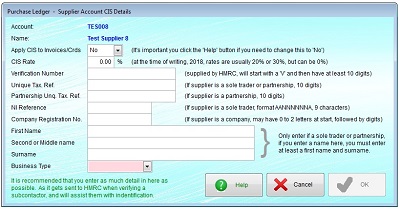

- All necessary information for a sub-contractor such as NI number, company number, business type, etc. all stored in their account

- Test Mode available so you can send test data to HMRC while learning how to use the software

- CIS Returns are created automatically, with the facility to allow user to edit

- Print statements to sub-contractors

- Various lists and reports available in connection with CIS